BUCYRUS, OH (CRAWFORD COUNTY NOW)—The city of Bucyrus is considering seeking advice from the state auditor to address its financial troubles.

This consideration was the only thing left standing after a meeting regarding the revocation of tax credits for out-of-town workers ended without any resolutions Wednesday night.

The Finance Committee, chaired by Kevin Myers, endured nearly three hours of presentations and input from discouraged out-of-town workers.

Towards the end of the meeting, council member James Mee made a motion to suspend the tax credit for 36 months. However, after facing resistance from community members, he amended the motion to a suspension period of 24 months. The second motion was not seconded, leading to confusion among committee members regarding the next steps.

One Bucyrus resident, Melanie Ellis, summed up the feelings in the room by telling the committee:

“You can’t expect the out-of-town workers to float the city’s bad decisions for the last 20 years.” Ellis said.

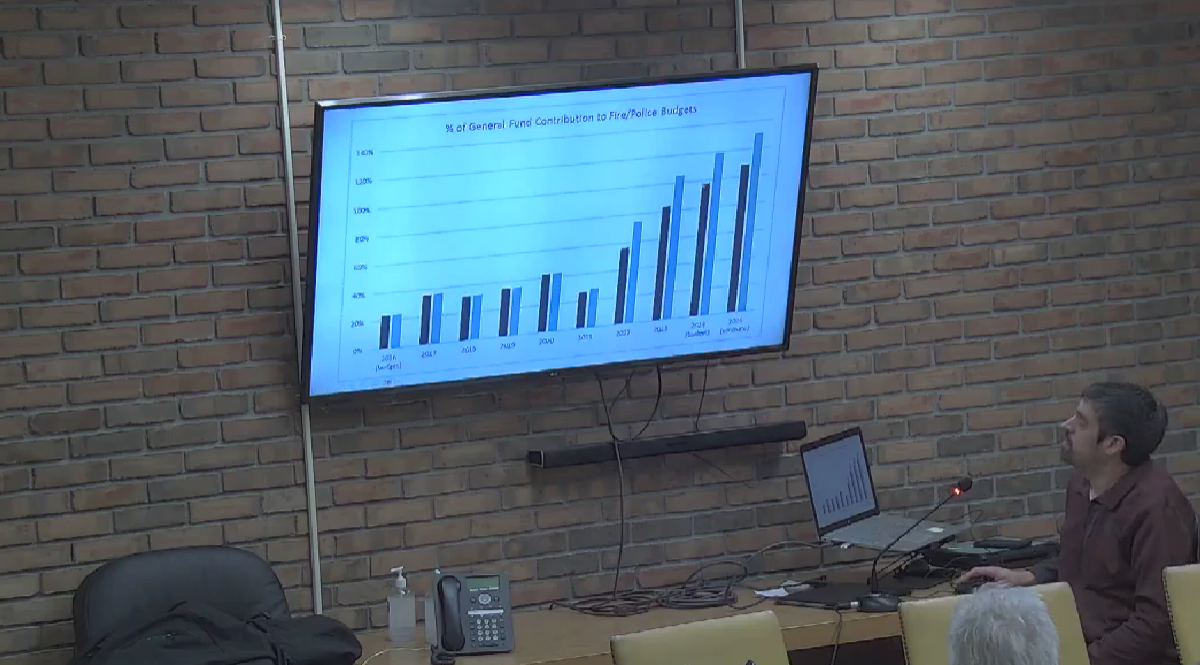

Ellis called out Kevin Myers, James Mee, Aaron Sharrock, Kurt Fankhauser, and Mayor Bruce Truka, who all sat on the council when the problems began midway through former Mayor Reser’s first term. Fankhauser, who put together a visual presentation of the city’s financial woes, reminded her that as Council President, he was not a voting member of council.

Fankhauser admitted that former Mayor Reser and auditor Joyce Schifer began sounding alarms.

He told council that based on his graphs, ARPA monies kept the city afloat and cuts were made each year. “There’s very little to cut,” Fankhauser said.

Resident and out-of-town worker Harold May expressed doubts that if tax credit suspension is introduced, it would later be revoked. He also urged residents to note who voted yes for rescinding the tax credit.

“If you give it up, it’s gone,” People need to know who votes yes, who voted no,” May said.

Mee’s initial motion to suspend the tax credit was influenced by sincere comments from city resident Max Miller, who expressed frustration over the lack of communication from city officials. Miller told the council he has lived in big and small towns in and outside the country. He and his partner chose to live in Bucyrus to be close to family and friends because it’s affordable and safe.

Miller indicated a willingness to negotiate on the tax credit issue if it was implemented as a temporary measure.

In response, Mee asked Miller if a two-year suspension would be acceptable, to which Miller agreed, seeing it as a starting point for negotiations.

Committee member Vicki Dishon suggested the idea of bringing in a state auditor to Bucyrus to assess the urgency of the city’s financial situation and determine if it falls under fiscal caution, fiscal watch, or fiscal emergency. “We need to know where we are.” Dishon said.

City Auditor Kali Lewis clarified that inviting a state auditor does not guarantee the avoidance of tax credit revocation.

She cautioned the Council not to pass this on to the state to avoid addressing it themselves.

According to a report, a full revocation of the 2% tax credit would result in a yearly cost of approximately $980 for a household with a median income of $49,021. A 1% revocation would amount to around $450.

The meeting ended with no resolutions or solutions.